WTO negotiations on Industrial Goods have progressed in Geneva based on the Framework Agreement signed in August 2004. The discussions have mainly been technical. However, the mini-ministerial at Davos, which was attended by 30 trade ministers, including Mr Kamal Nath, Minister of Commerce, Govt of India has given a very strong political push to these negotiations.

The following is the state of progress of NAMA negotiations till the Trade Negotiations Committee Meeting on February 14, 2005.

Product Coverage:

The main discussion on this has been what all products will NAMA cover. There is still some discussion on whether fish and fish products should be sent into agriculture or should they remain in the realm of industrial goods. This is because fish and fish products is one of the products that has been identified for sectoral initiative of zero for zero.

There is also this issue of deciding which of the environmental goods will be taken into the NAMA negotiations for reduction/elimination of tariffs. The environmental goods negotiations are done under the Trade and Environment Committee and not Negotiating Group on NAMA.

Bound vs. Unbound:

Many countries (all developed and many Latin American Countries) have called for complete binding of all tariffs by all countries. They also want LDCs to bind their tariffs without providing for any tariff reductions. India has, however, said in these discussions that there cannot be automatic binding of all tariffs. Sensitive products will have to remain unbound, India said. Philippines and Kenya share this view.

EU has said that if any country wants to use the exceptions given in the Framework Agreement then these exceptions will have to be compensated in other areas. EU said that the level of ambition in the Doha Round should not be compromised at any cost.

Formula:

There is not much progress on the formula on the ground. However, USTR Robert Zoellick’s statement at the Davos mini-Ministerial that there can be two coefficients for the formula - one for developing countries and the other for the developed countires - has started a debate in WTO circles. The effect of such formula is supposed to ensure that all high tariffs are cut more substantially than low tariffs, but the separate coefficient for developing countries will allow them to bring their tariffs to a higher absolute ceiling than developed countries.

US negotiators have, however, indicated that application of such formula will mean reduction in flexibilities. Flexibilities include keeping a percentage of tariffs outside the bound level or keeping some products out of the formula for lower cuts, both of which is included in the

The EU felt that this can possibly bring down the “level of ambition” in the Doha Round. They said that the Framework Agreement in itself provides for enough flexibility.

Treatment of Unbound Formula:

There is no consensus on the way to proceed. Countries like India have insisted that some sensitive products have to be left unbound while many countries have questioned this. Countries like Peru and Ecuador have asked all developing countries to bind 100% of their tariffs.

US said that the problem of having unbound tariffs is only with 30 countries and therefore it can only be an exception but not the rule.

Reactions from Various Countries:

India:

Developing countries should be given the flexibility to cut less than what the developed countries cut tariffs. There should be a window for keeping sensitive products unbound as well.

Jamaica/Cuba/ Costa Rica:

Larger implementation period required for deeper cuts. Different coefficients should be applied for developing and developed countries.

Kenya:

Without flexibility the word development will elude the negotiations. Level of ambition should be on development perspective of the Round.

Sectoral Initiative:

There is need for flexibility while deciding on sectoral, is what most developing countries are saying. But flexibility means different things to different countries.

Latin America including Brazil seems okay with sectoral initiatives (zero for zero) if it is voluntary.

Switzerland is for the critical mass approach.

US has said that sectoral initiative is key to any tariff reduction formula to be agreed.

What is Voluntary Approach in Sectoral Initiatives?

Voluntary will mean that countries can choose if they want to join the sectoral initiative or not. But if they decide to join then they will have to do so for all sectors that are brought under the sectoral initiative. If countries decide to stay away from the sectoral initiative then they will have to pay a MFN duty for export of those products, which will be fixed during the negotiations.

Sectors will have to be negotiated but as of now the products that were decided earlier still stand - auto components, electrical and electronic products, footwear and leather goods, textiles and clothing, fish and fish products and gems and jewellery.

But the US and Japan want more products added to this list.

What is critical mass approach?

In a meeting held last week it was decided that they would look at the same approach that was taken for the Information Technology Agreement. They feel that countries that account for 80 per cent of total global trade in the product will be part of the critical mass. Those outside can choose to join or not. India may be included in every sector if this approach is accepted.

Special Provisions for Newly Acceded Countries:

China has been leading this discussion and has said that newly acceded countries will need a completely different coefficient that will have smaller cuts in tariffs and longer implementation periods for these cuts. :

Elimination of Low Duties:

Most developed countries have demanded that all countries must eliminate any low tariff completely to provide immediate market access opportunities in global trade.

Most developing countries have rejected this proposal. Kenya specifically said that it was important for developing countries to keep nuisance tariffs.

Nonreciprocal Preferences:

There have been short discussions on this issue. Many countries that do not receive such preferences have said that they need to be removed. However, there is a lot of support for such non-reciprocal preferences especially from ACP countries that receive such preferences from EU.

Non-tariff Barriers:

Two papers were presented on non-tariff barriers. One of the papers was from US on automobiles and another from US and New Zealand on wood products.

India and many other developing countries have called for higher attention to this area of negotiations.

India has submitted a proposal jointly with Brazil and Argentina on Tariffs:

Communication to the Negotiating Group on Non-Agricultural Market Access from Argentina, Brazil & India

- The Framework contained in Annex B to the July Framework Agreement represents the mandate provided for the non-agricultural products negotiations in paragraph 16 of the DMD. Accordingly, the formula shall reduce tariff peaks, high tariffs and tariff escalation and take fully into account "less than full reciprocity in reduction commitments” and special & differential treatment for developing countries.

- The concepts of “less than full reciprocity in reduction commitments” and “special & differential treatment” are different:

(i) "Less than full reciprocity in reduction commitments” has to be an in-built component of the formula and would be achieved through the incorporation of sufficiently higher coefficients for developing countries as compared to developed countries, resulting in higher percentage reductions for developed countries and taking into account the differences in tariff profile amongst members;

(ii) Special & differential treatment relates to flexibilities in the application of the formula, including longer implementation periods, less than formula cuts and the exclusion of some tariff lines. The present structure of the S&D provisions in the Framework contained in paragraph 8 of Annex B is the minimum necessary to meet the development goals of the developing countries in this regard.

- Harmonization of tariffs is not an objective of this Round. It has not been envisaged in the Mandate and was not included in the July Framework as one of the necessary features of the formula. Harmonizing the customs tariffs amongst countries with differing industrial/ economic structures and with varying societal needs is not desirable and would not deliver the development objective of the Round.

- After consideration of the various formulae proposed for these negotiations, a Swiss ‘type’ formula incorporating each country’s tariff average seems best suited to address the mandate in its entirety. This could be expressed as:

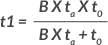

where,

t1 is the final rate, to be bound in ad valorem terms

t0 is the bound base rate

ta is the average of the current bound rates

B is a coefficient, its value(s) to be determined by the participants

The defining features of this formula are as follows: - The ‘formula’ would apply to bound tariff lines; and - The coefficient ‘B’ will be modulated to reflect the ambition in other areas relevant to market access agreed to for this Round;

- All non-ad valorem duties shall be converted to ad valorem equivalents before the adoption of the formula, and bound in ad valorem terms.

- This is an equitable formula as it takes into account the present tariff commitments of Members. It improves the tariff profiles by compressing the dispersion of tariffs within each Member. It is transparent as it uses a well known factor, each Member’s tariff average, as the basis. It seeks to match the ambition level in all areas of market access negotiations in the WTO, with the inclusion of a ‘B’ factor. The overall reduction commitment it imposes in percentage terms is proportional amongst developed and developing countries, removing the shortcoming in the simple Swiss formula that imposes much greater reduction requirements on the participating developing countries.

- The impact of any tariff reduction formula depends on the numbers which are the essence of the formula. At this stage the important consideration is whether the formula by its nature complies with the mandate, i.e. whether it reduces or eliminates tariff peaks, high tariffs, and tariff escalation taking fully into account the special needs and interests of developing and least-developed country participants, including through less than full reciprocity in reduction commitments. We believe the above formula is still the most appropriate because:

It is based on the current tariff profile;

It has an element of progressivity in national tariffs;

It allows for less than full reciprocity in reduction commitments; and

Its liberalizing effect can be adjusted by variations in the coefficient ‘B’.

- Having agreed on the basic structure of the formula, Members would have to address the part of the mandate related to Special and Differential treatment for developing country participants in the application of the formula on current bound tariffs. Particular sensitivities of developing countries would be attended by longer implementation periods, less than formula cuts for some tariff lines and the exclusion of some tariff lines from any formula cut. The figures related to those flexibilities would have to be negotiated after an agreement on the formula itself.

Treatment of Unbound Tariff Lines

- Increasing the binding coverage to 100% is a desirable objective for this Round. However, it must be recognized that appropriate flexibilities are required by developing countries to achieve this objective. The average as on the base date of presently unbound lines will be marked up by x times, which shall be negotiated as indicated in the framework agreement. Thereafter, the marked up unbound tariff lines could be bound at an average level after the application of the formula. Developing country Members would then have the flexibility to fix individual tariff lines around this average. The formula for unbound tariff lines will be slightly modified i.e., the formula would apply only on the tariff average and not on a line by line basis. The modified formula for unbound tariff lines shall be as follows:

Where:

tA1 is the average for newly bound lines

xtA is the marked up tariff average of MFN applied rates as on the base date

tA is the tariff average of MFN applied rates as on the base date

B is a coefficient, its value(s) to be determined by the participants

Members covered by paragraphs 6&9 of Annex B of the framework shall not undertake tariff reductions in this Round. Members should also recognize liberalisation recently undergone by newly acceded members.